Unicorn Listing: A Confidence Game

Since the launch of Dual Class Shares (DCS), different opinions have emerged in the market. The first ‘new economy’ company to be listed with ‘different classes of shares and super voting powers’ is Xiaomi, which has become a trailblazer for HKEx following the introduction of DCS.

DCS is a share arrangement specially suited to unicorn companies. Innovative tech companies with exceptional potential often have immense capital needs, requiring multiple rounds of financing. This can result in the dilution of the founders’ equity which in some cases may be reduced to less than 10%. Under DCS, the founders can still maintain a high degree of control during the financial expansion process – allowing the company to focus on innovation while minimizing the threat of hostile takeovers. But to what degree and for how long can the current system in Hong Kong allow the founders of these companies with dual-class shares to pursue and realize their corporate vision?

In short, investing in a unicorn company with such a shareholding structure is a confidence game. Investors pay real money to indicate their confidence in the founders of the company and its unique vision, cutting-edge technology and business philosophy. Their investments affirm the extraordinary growth potential of such industries that cannot be accurately predicted or estimated.

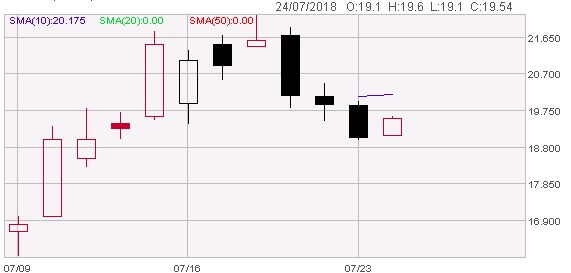

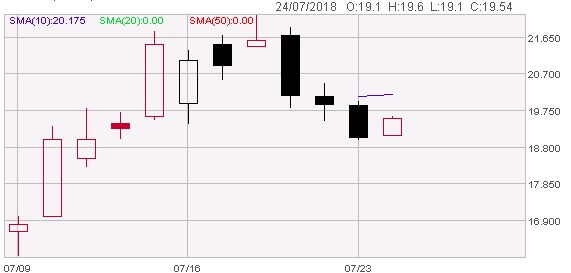

Xiaomi is the first unicorn to be listed under DCS. However, even local and overseas institutional investors who have consistently invested in Hong Kong stocks are not prepared to go beyond the traditional valuation framework. Many of them focus on the stock valuations and growth rate of existing businesses. In fact, in addition to its mobile phone division, Xiaomi has built an ‘eco-sphere’ business comprising smart home and software services. When valuing the company, one cannot simply compare it to competitors in mobile phones and other high-tech industries, and it is too early to judge whether its current valuation is reasonable. Moreover, corporate valuations are closely related to stock market sentiment. Investors raise their valuations during bull markets and vice versa. The share prices of newly listed companies are particularly volatile and only stocks that have been listed for some time reflect the true company value.

Tencent Music, another unicorn company, is seeking to list in the US. According to word on the street, this is because Hong Kong has still not accepted the DCS structure with corporate beneficiaries[1], and US investors seem prepared to offer higher valuations for streaming music platforms. Both factors are clear incentives for Tencent Music to seek a US listing. Spotify, the Swedish streaming music platform, is an obvious peer of Tencent Music. Since Spotify was listed on the NYSE this April, its stock price has risen by over 40% and its market value is now worth US$33.4 billion. Upon listing, Tencent Music is expected to be compared to Spotify and achieve a valuation of up to US$30 billion.

Hong Kong’s DCS can reach an equilibrium only by establishing a sound system to protect the interests of ordinary shareholders and employees, and establishing mutual trust among shareholders with different class of ‘shares’ and ‘rights’ to ensure the fulfillment of rights and obligations by both parties.

In 2015, Dr. Maurice Wai-fung Ngai, Chief Executive Officer of SWCS, participated in an academic seminar on DCS held by the The University of Hong Kong when he was the President of The Hong Kong Institute of Chartered Secretaries. The seminar concluded that investors, along with censors and regulators in Hong Kong, were not mature enough to accept and invest in unicorn companies through DCS. Even though listing of such equity structures has been accepted in the US market for over a decade, many local scholars and market participants question whether DCS can fully protect the interests of ordinary shareholders.

Index companies around the world have their own views on this kind of equity structure. For example, Xiaomi has been accepted as a constituent stock of various local and overseas indices. These include HSI which has listed Xiaomi in its Hang Seng Composite Index, Hang Seng Global Composite Index and Hang Seng Internet Technology Industry Index[2]. International Index Company FTSE has included Xiaomi on six of its indexes including the FTSE China 50 Index[3], FTSE Global Index and FTSE Emerging Markets Index. However, the Shanghai and Shenzhen Stock Exchanges have refused to include new members in the Hang Seng Composite Index using DCS in Hong Kong Stock Connect on the grounds that most PRC investors do not fully understand such structures.

Many international index companies also have reservations about this equity arrangement. S&P announced in August last year that the S&P 1500 index (including the S&P 500, 400 and 600 indices) which reflects the performance of US stocks and the US economy, will no longer accept new companies with DCS because of stricter requirements for their index stocks. For example, stocks must maintain liquidity of less than 50% in the open market and also meet profit requirements under US accounting standards. It therefore decided to change the index calculation method to exclude new companies with DCS. Existing constituent stocks in the index with DCS structures were exempted including Alphabet Inc. , Google’s parent company, and Buffett’s Berkshire Hathaway[4]. MSCI is also considering reducing the number of companies with DCS structures in its index.

Countries that currently allow listings with this shareholding structure include Australia, Brazil, Canada, Chile, Denmark, Finland, France, Germany, Italy, Mexico, Norway, South Africa, South Korea, Sweden, Switzerland, the UK, and the US[5]. Traditional companies which have DCS structures include Ford (the Ford family still controls the company with a maximum of 40% ownership); technology companies such as Alibaba, Google, Facebook and LinkedIn; and media companies such as News Corps. All of them allow the company founders to retain a high degree of control. Hong Kong is following the global trend to accept DCS structures. Given that DCS structures vary, Hong Kong should reference international cases and learn from their strengths and weaknesses. To perfect its DCS system, at least three areas need to be clarified: valuing innovative companies, implementing employee equity incentives, and strengthening the knowledge and skills of directors (especially independent non-executive directors). Successfully implementing a DCS system will provide comfort and security to shareholders and investors, and help create a thriving investment sector for unicorns.

Directors must have sufficient experience and/or expertise to understand and verify the valuation of innovative companies

Before Xiaomi submitted its listing application, the financial media published various types of valuation for the market to consider. Since the methods for valuing unicorns are usually very different to those of traditional enterprises, directors must have sufficient experience / expertise in the relevant business areas, and in profit forecasting and valuations. Directors should maintain a critical attitude towards the valuation methods, calculation benchmarks, scope of review, and assumptions and limitations used by the valuer, and not overly rely on valuation reports.

Make good use of equity incentives to ensure the stability of the company’s management

The DCS system allows the founders to retain absolute control over the company, and thereby maintain their passion to keep it evolving in an ever-changing market. But how to encourage a sense of responsibility and enthusiasm among staff and management? Let’s consider Alibaba which has three types of equity incentive plans: restricted share unit plan, share option plans, and share award plans for staff and management. Companies with DCS can offer similar incentives after listing. Under an Employee Stock Ownership Plan (ESOP), staff and management teams are given an equity stake making them corporate owners rather than simple employees. Aligning their personal interests with those of the company increases commitment and engagement which will help take the company to a higher level. Of course, to prevent companies from abusing equity incentive plans, the regulatory authority must effectively monitor them. For example, detailed explanations should be required when a company offers employees and management share options and equity interests.

To attract, motivate, retain and reward employees and directors, Xiaomi has granted equity incentives on several occasions. According to Xiaomi’s prospectus for Chinese Depository Receipt, as of May 2018 more than 5,500 employees are interested in the company’s employee equity plans (including stock options and restricted stocks) and a total of 244.5 million B-class share options have not yet been exercised[6]. In general meetings, each Class A share has 10 votes and each Class B share one vote. The Board of Directors issued around 64 million Class B shares to Lei Jun, the company founder, in return for his contribution. Such equity incentives worth RMB 9.83 billion[7] were recognized as share-based compensation expenses. This arrangement has caught the attention of mainstream media as incentive schemes rewarding the founders of start-up tech companies are usually linked to future business performance. However, in this instance, Xiaomi has not offered any such reason. Nonetheless, Lei Jun’s shareholding is subject to a one-year lock-up period. He currently holds around 31.41% of the company’s shares which will reduce to 28% if ESOP options are taken into account. Yet through this DCS structure, Lei Jun’s voting rights exceeded 50% giving him absolute control over Xiaomi[8][8].

Handing control of listed companies to founders and providing equity incentives to senior executives is not new to Silicon Valley. But the founders of Snap, a US listed company, raised the bar for corporate control. Only non-voting shares were issued in the initial public offering. Class B shares allotted to investment institutions had 1 vote per share whereas Class C shares held by the two founders had 10 votes per share. The Chief Executives Officer and co-founders were offered a substantial number of share rewards. For Dropbox, which listed after Snap, Class A shares have 1 vote per share and Class B shares 10 votes whereas Class C shares have no voting rights. Class A shares were issued to the public, and Class B shares to the management team led by the founder and chief executive officer Drew Houston; and to Sequoia Capital, a venture capital firm. Class B shareholders own more than half the voting rights, and Class C shares are granted under an employee stock purchase plan. Dropbox has therefore adopted a more moderate share structure than Snap which does not offer ordinary investors any voting rights.

Voting rights of DCS companies

Xiaomi

Snap

Dropbox [9]

General investors

Class A: 10 votes per share

Class B: 1 vote per share

Class A: No voting rights

Class B: 1 vote per share

Class C: 10 votes per share

Class A: 1 vote per share

Class B: 10 votes per share

Class C: No voting rights

Proportion of voting rights of owners with different rights beneficiaries

84.26% [10]

88.5% [11]

98% [12]

When holders of ordinary shares have extremely low or no voting rights, the company will soon be spurned by investors ultimately undermining its long-term development. In such a confidence game, the founders must let investors believe in the company’s future development and growth prospects.

Singapore has revised its listing requirements for companies with DCS structures and proposed various countermeasures. After listing, for example, the voting rights of DCS holders cannot be changed. At the same time, when shareholders approve various matters – including changes to the issuer’s articles of association or other constitutional documents; changes of rights attached to any class of shares; appointing and removing independent directors or auditors; liquidation or de-listing and so on [13] [1] – shares with super voting rights can only be used on a one vote per share basis.

With regard to the current listing rules in Hong Kong, companies with DCS schemes must disclose the proportion of shareholders with super-voting rights and the dilution effects arising from conversion of those shares to ordinary shares. On major issues, votes must be taken on a ‘one share, one vote’ basis including amendments to constitutional documents, appointments and removal of independent non-executive directors, appointments and dismissal of auditors, changes in rights attached to any class of shares, and voluntary liquidation by the issuer[14].

According to a study of corporate governance among Canadian companies with DCS, half of those sampled have sunset clauses and most have appointed independent directors. In fact, less than one-third of DCS companies changed the control clause beyond the existing laws. In other words, once a company is listed, the DCS system can only be maintained for a limited period unless further approval is obtained from minority shareholders. Indeed, the DCS system is a legally acceptable method which allows the founders to pursue steady long-term development strategies. However, when the company makes decisions which do not maximize shareholder value, such as when management performs poorly or when incompetent staff are assigned to control the company’s operations and so on, the interests of ordinary shareholders are at risk of being abused. At the annual meeting, a majority of minority shareholders can agree and vote for a sunset clause with a time limit which will reduce such risks by prohibiting a permanent DCS system[15].

Comparison of DCS between Singapore and Hong Kong [15]

HKEx

SGX

Different rights holders

Must be individual

Individual or company

Appointing and removing independent directors, auditors, reverse takeovers, liquidation or de-listing etc.

Must be ‘one share, one vote’

Must be ‘one share, one vote’

Different rights shares only represent 10 votes at most

Y

Y

If the founder leaves the company, dies or transfers shares, their share privilege will lapse

Y

Y

Establishing appropriate sunset clauses based on the nature of business

According to a study of corporate governance among Canadian companies with DCS, half of those sampled have sunset clauses and most have appointed independent directors. In fact, less than one-third of DCS companies changed the control clause beyond the existing laws. In other words, once a company is listed, the DCS system can only be maintained for a limited period unless further approval is obtained from minority shareholders. Indeed, the DCS system is a legally acceptable method which allows the founders to pursue steady long-term development strategies. However, when the company makes decisions which do not maximize shareholder value, such as when management performs poorly or when incompetent staff are assigned to control the company’s operations and so on, the interests of ordinary shareholders are at risk of being abused. At the annual meeting, a majority of minority shareholders can agree and vote for a sunset clause with a time limit which will reduce such risks by prohibiting a permanent DCS system[16].

After two rounds of consultation on DCS, the Singapore Stock Exchange finally proposed an event-based sunset clause requiring companies to set up sunset clauses which must be explained during the IPO. including when shares with super voting rights will automatically convert back to one share one right [17].

Sunset Clause

The United Kingdom [18]

No mandatory ‘sunset clause’

The United States

No mandatory ‘sunset clause’

Hong Kong [19]

Further consultation with corporate beneficiaries will be conducted on DCS in which sunset clauses with time limits will be discussed

Singapore

Companies are required to implement a ‘sunset clause’

Under the DCS system, shareholders must pay a greater agency cost to supervise the operations and the implementation of corporate governance of the company. But reasonable agency costs can build mutual trust between ordinary shareholders and shareholders with super voting rights.

Of course, in both theory and practice there is still controversy on whether companies with DCS structures incur higher agency costs than companies with shares of a single class, and whether shareholders’ rights and interests are compromised. So how can the internal control mechanism of companies with DCS structures be improved to ensure

effective supervision of the controlling shareholders? Various solutions have been proposed. First, appropriate restrictions on the use of super-voting rights including limitations on the difference between voting rights of different class shares should make the application scope of super-voting rights as clear as possible. Second, transparent exit and transfer mechanisms for super-voting rights should be established including the commonly known ‘sunset clause’ and transfer of super-voting rights shares. Third, corporate governance should be structured in a way that combines both internal and external restraint mechanisms.

In addition to the sunset clause, some innovative companies with unique business and technical advantages may stand out from the industry while others may become ‘fish in troubled waters.’ Therefore, it is important to have a listing committee which fully understands the company’s business. Currently, most members of the HKEx listing committee come from traditional professional circles including investment, law and accounting. It is unclear whether they fully grasp the latest developments, innovations and business models among today’s start-up industries, and can therefore accurately interpret the financial statements and accounting assumptions of pre-Profits companies. It is also unclear whether they can accurately evaluate all listing applications. A committee with a comprehensive understanding of the business model can judge its feasibility and uniqueness. From the perspective of an ordinary investor, this might take the form of monitoring business development and board operations, and through enhancing corporate governance.

The emergence of companies with DCS is undoubtedly placing higher demands on corporate governance. As the business models of new economy companies become increasingly complex, financial institutions and other investors require them to be more transparent and the role of company secretaries becomes increasingly important as they assume even broader responsibilities.

Independent non-executive directors should keep pace with the market to ensure professionalism and independence

At the US congressional hearing, Facebook’s CEO, Mark Zuckerberg, was questioned about Facebook’s revenue model by senators who do not use social networks which led to numerous jokes and memes. Companies with DCS are typically developing new technologies, exploring innovative ideas, or pioneering new business models. Moreover, HKEx has also opened the door to biotech companies with no revenue (Pre-Revenue). A biotech company that only appoints accountants, lawyers and other professionals as independent non-executive directors runs the risk of another Facebook-style fiasco if they are faced with a lot of medical terminology. These companies should therefore consider appointing medical professionals as independent non-executive directors who can knowledgeably advise on business operations.

With the largest number of DCS companies, the US has the most lenient regulations. However, the US market is also known for its high degree of transparency and frequency of class-action litigations. In Hong Kong and Asia, decisions of listed companies mainly require shareholders’ approval. There are no protection mechanisms such as class actions to prevent founders from going their own way and making wrong decisions which are detrimental to small investors. Therefore, the role of independent non-executive directors is especially important.

These independent non-executive directors act as key persons in corporate governance and give out balanced and fair opinion. They can also enhance a company’s transparency and disclosure level, ensuring that all decisions made by the Board of Directors are reasonable and fully comply with the listing rules. It is essential for them to be familiar with the agenda of the shareholders meeting and agreed goals, and to have skills and detailed knowledge of the above in respect to new economy compliance requirements.

With extensive experience in providing training for directors and management, SWCS Corporate Services Group (Hong Kong) Limited enables companies to have a clearer understanding of the latest listing rules. Independent non-executive directors are then better able to play a ‘governance and regulatory role to protect the rights and interests of minority shareholders, and to have a comprehensive understanding of the company’s affairs.

Hiring an independent non executive director who understands the industry characteristics and DCS system is never easy. However, training can greatly enhance the performance of independent non-executive directors. SWCS Corporate Services Group (Hong Kong) Limited owns a team of professionals with strong operational capabilities such as lawyers, accountants and chartered company secretaries who possess rich experience in corporate governance training, enabling independent non-executive directors with diverse backgrounds and qualifications to contribute their skills and expertise.

[1] 《Tencent Music invites banks to pitch for role in up to $4 billion U.S. IPO: IFR》

https://www.reuters.com/article/us-tencent-music-ipo/tencent-music-invites-banks-to-pitch-for-role-in-up-to-4-billion-u-s-ipo-ifr-idUSKBN1I10ZT

[2] 《小米7月23日起獲納入恒生綜合指數》

https://www2.hkej.com/instantnews/hongkong/article/1885872

[3] 《富時︰最少3.6億被動資金需追買小米》

https://m.mingpao.com/fin/instantf2.php?node=1531226944530&issue=20180710

[4] 《富時︰最少3.6億被動資金需追買小米》

https://m.mingpao.com/fin/instantf2.php?node=1531226944530&issue=20180710

[5] 《同股不同權的利與弊》

https://www.fbe.hku.hk/page/detail/75266

[6] 《小米CDR招股書:雷軍有57.9%投票權》

http://finance.sina.com.cn/stock/hkstock/hkstocknews/2018-06-12/doc-ihcufqih3383764.shtml

[7] 小米招股書P.78

https://www.hkexnews.hk/listedco/listconews/SEHK/2018/0625/LTN20180625034_C.pdf

[8] 《小米赴港IPO,千名員工暢想“財富自由”征途》

https://www.xinhuanet.com/fortune/2018-05/07/c_129866046.htm

[9] 《Dropbox IPO is yet another corporate governance low point》

https://www.ft.com/content/4333c554-279a-11e8-b27e-cc62a39d57a0

https://www.sec.gov/Archives/edgar/data/1467623/000119312518055809/d451946dex105.htm

[10] 小米招股書P.390

[11] 《One way Snapchat’s IPO will be unique: The shares won’t come with voting rights》https://www.recode.net/2017/2/21/14670314/snap-ipo-stock-voting-structure

[12] 《Has Dropbox Already Peaked? Or Does This Unicorn Have More to Run?》

https://www.barrons.com/articles/has-dropbox-already-peaked-or-does-this-unicorn-have-more-to-run-1521748989

[13] 《Listing of Companies with Dual Class Shares》

https://www.allenovery.com/publications/en-gb/Pages/Listing-of-Companies-with-Dual-Class-Shares-SGX-Proposes-Listing-Rules-Amendments-.aspx

[14] 《諮詢總結 新興及創新產業公司上市制度 》P.58

https://www.hkex.com.hk/-/media/HKEX-Market/News/Market-Consultations/2016-Present/February-2018-Emerging-and-Innovative-Sectors/Conclusions-(April-2018)/cp201802cc_c.pdf

[15] 《Enhancing Governance in Dual-Class Share Firms》

Enhancing Governance in Dual-Class Share Firms

[16] 《SGX opens listing to firms with dual class shares》

https://sbr.com.sg/markets-investing/news/sgx-opens-listing-firms-dual-class-shares

[17] 《同股不同權設保障投資者措施》

https://www.news.gov.hk/chi/2018/05/20180527/20180527_081956_528.html

[18] 《企業WVR倡日落條款最長15年》

https://www1.hkej.com/dailynews/article/id/1887247/